Investor Relations

Our Firm Essentials

CEO’s Letter to Investors

Dear Esteemed Investors,

As we stand on the cusp of an exciting new chapter at Al-Ahram Group, I am eager to share with you the vision that will guide us into a prosperous future. Our unwavering commitment to innovation, quality, and sustainability is set to unlock unprecedented opportunities for growth and value creation.

Looking ahead, we are poised to capitalize on emerging market trends with agility and strategic foresight. Our investments in cutting-edge technology and sustainable practices are not just about adapting to change—they are about leading it. We are expanding our reach, diversifying our portfolio, and strengthening our presence in key markets to ensure that Al-Ahram Group remains at the forefront of the industry.

Our financial health is robust, and our strategic initiatives are designed to further enhance our market position and financial performance. We are committed to delivering consistent, long-term returns to you, our valued investors, who play a crucial role in our journey.

I am confident that together, we will achieve remarkable success and forge a legacy that stands the test of time. Thank you for your trust and investment in Al-Ahram Group. The future is bright, and we are just getting started.

Warmest regards,

Hany Halim

CEO, Al-Ahram Group

Financial and Operational Highlights

At Al-Ahram Plastic Company. We are committed to transparency and providing our investors with comprehensive insights into our financial health and operational milestones. Here, we present key highlights that underscore our market position and strategic vision for growth and sustainability.

Financial Performance

- Growth Trajectory

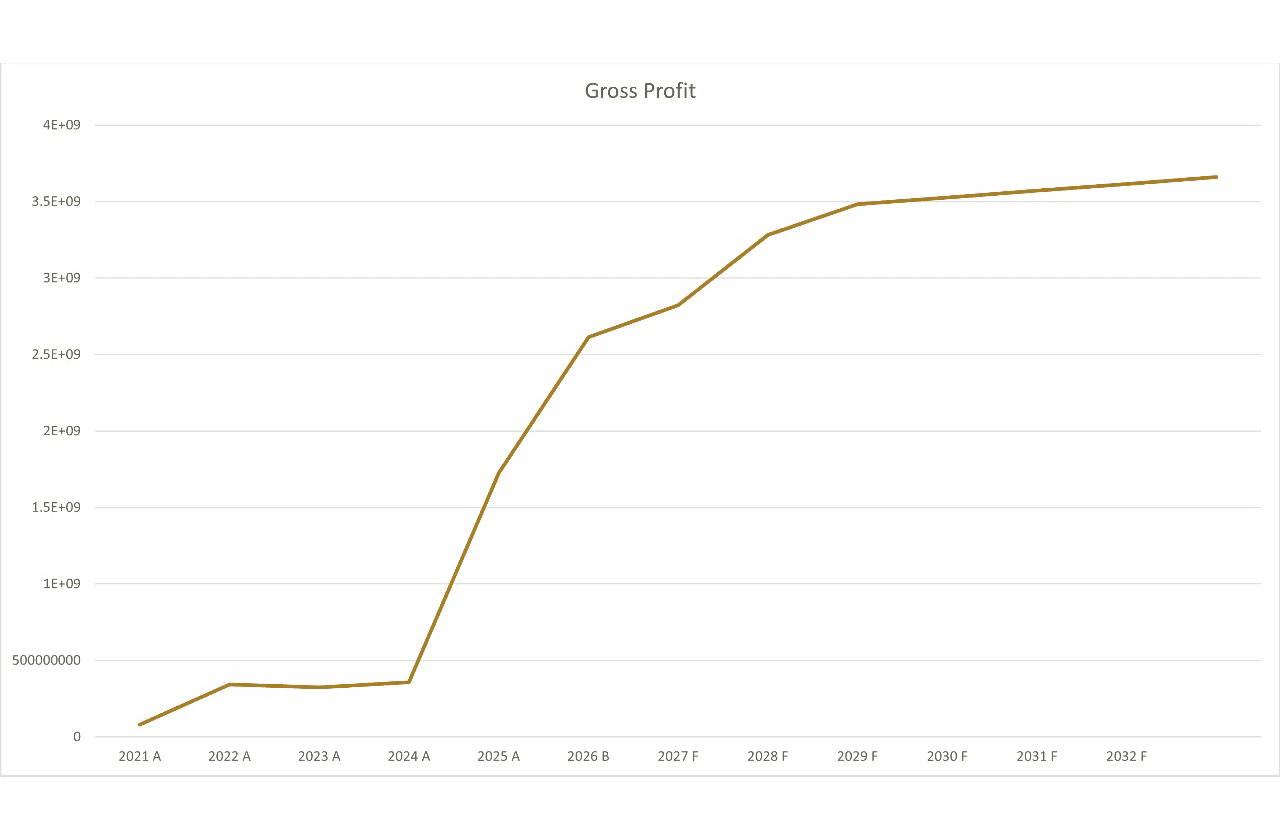

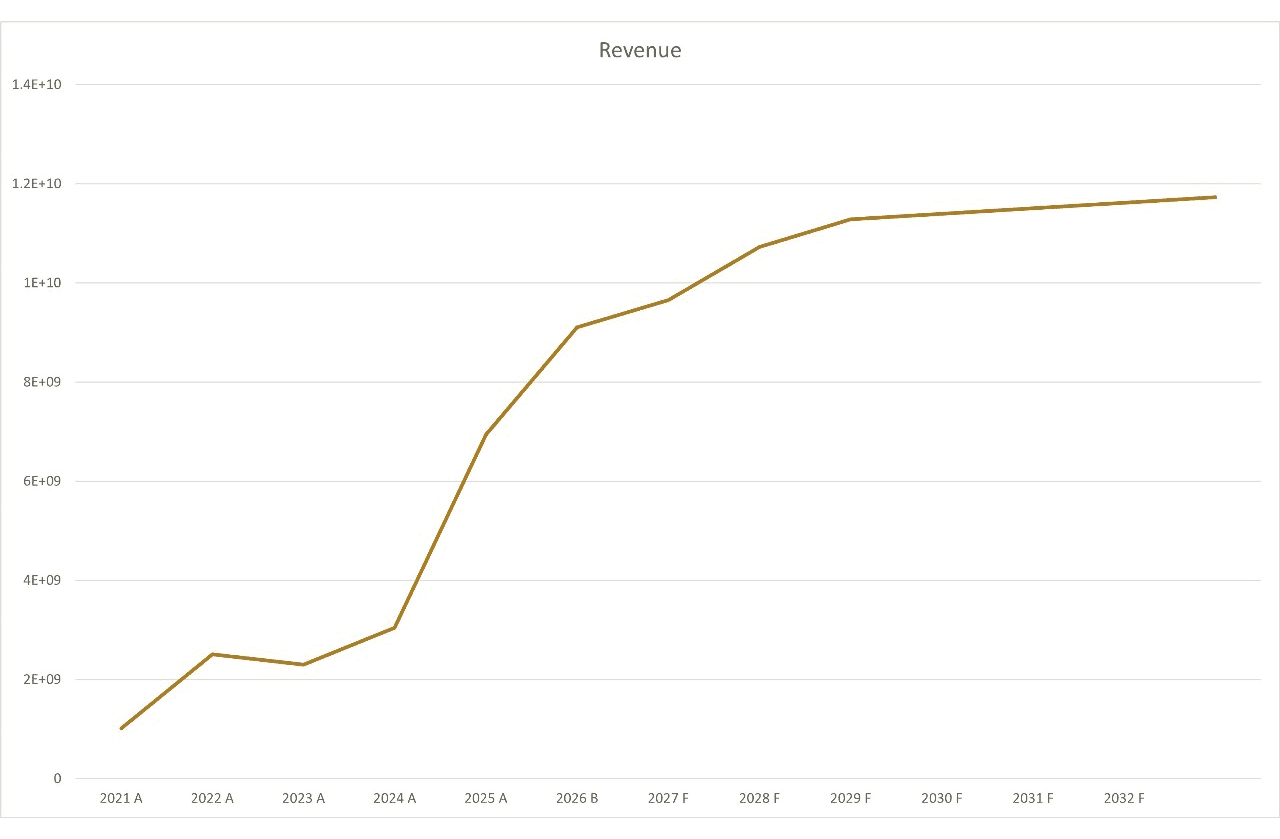

Al-Ahram has demonstrated a robust growth pattern, with revenue projected to increase from EGP 2.3 billion in 2022 to EGP 10.7 billion by 2027.

- Profitability

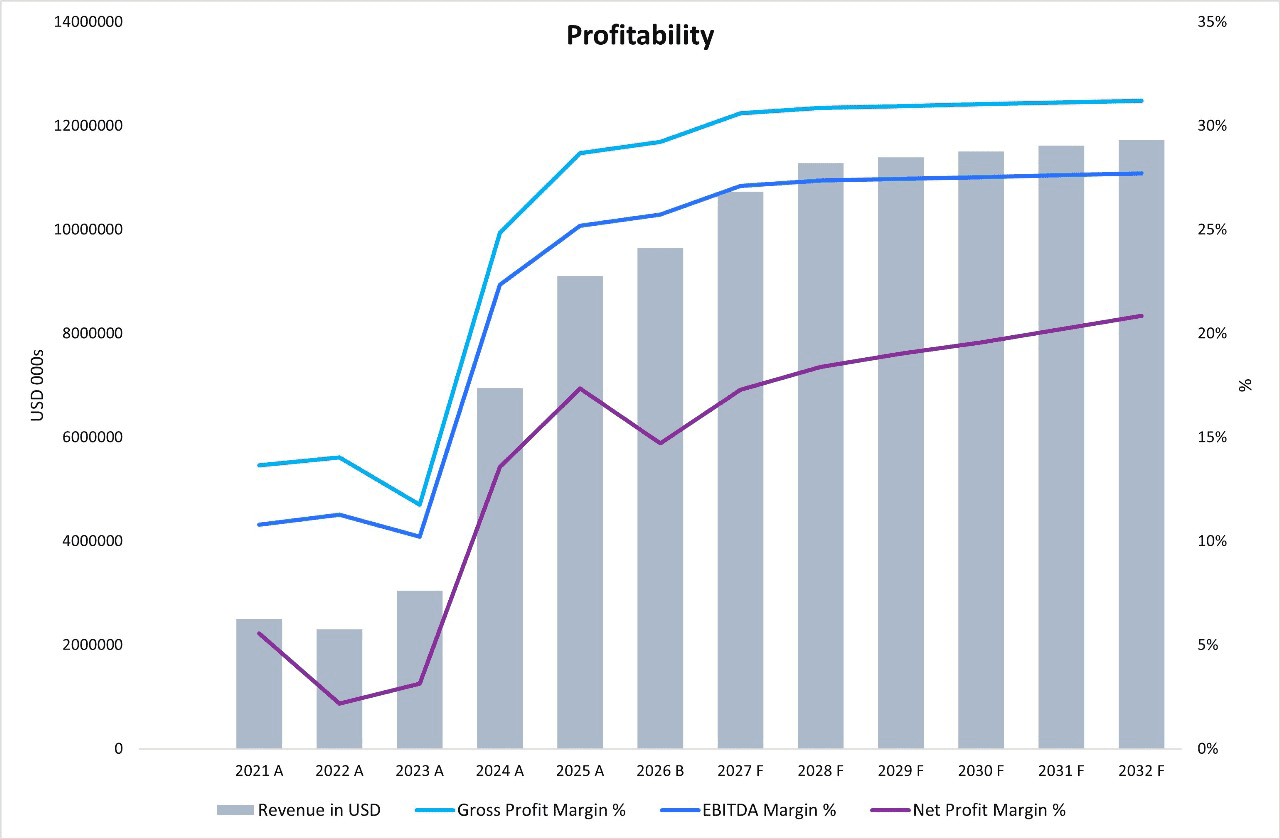

Our return on equity is set to improve from 18% in 2021 to 32% in 2026, reflecting our enhanced profitability and efficient capital utilization.

- Expansion Initiatives

We have doubled our production solid capacity from 34,094 TPA, reinforcing our commitment to meeting the growing demands of the market.

- Investment in Sustainability

Al-Ahram is at the forefront of eco-friendly production, investing 40 million EGP in plastic recycling facilities, with plans to increase to 150 million EGP in the next five years.

Operational Exellence

- State-of-the-Art Facilities

Our production facilities are equipped with advanced machinery, boasting an installed solid capacity of 34,094 tons per year.

- Quality Standards

We maintain high-quality standards with certifications such as ISO 9001, ISO 22000, ISO 14001, and ISO 45001.

- Strategic Expansion

Al-Ahram has expanded its geographical footprint by establishing warehouses and distribution centers across key locations in Egypt.

- Community Engagement

Through initiatives like the Teeba Foundation, we are making a positive impact on the lives of people in Upper Egypt.

Investing as “A Strategic Opportunity”

- Robust Financial Performance

With a solid financial track record and a projected CAGR of 14.8% from 2022 to 2027, Al-Ahram Group stands as a testament to sustainable growth and profitability.

- Innovation at the Core

Our investment in state-of-the-art technology and R&D initiatives ensures that we remain at the cutting edge of the plastic manufacturing industry.

- Sustainability Leadership

As pioneers in the circular economy, our move towards bio-plastics and recycling aligns with global environmental trends, offering products that meet the stringent demands of eco-conscious markets.

- Diversified Product Portfolio

From oxo-degradable plastics to rigid packaging solutions, our wide range of products serves various sectors, including food, agriculture, logistics, and pharmaceuticals, mitigating market-specific risks.

- Strategic Market Expansion

Our deliberate expansion into European markets with bio-compostable products demonstrates our commitment to capturing new growth opportunities.

- Export Capacity Enhancement

With a significant presence in the Middle East, Africa, and Europe, we are continuously working to increase our export capacities, broadening our global footprint.

- Community and Social Responsibility

Our involvement with initiatives like the Teeba Foundation highlights our commitment to social responsibility and community engagement, enhancing our corporate reputation.

- Experienced Leadership

Guided by a team of seasoned professionals, Al-Ahram Group is well-positioned to leverage opportunities and navigate challenges in the dynamic plastics manufacturing landscape.

Why Should You Invest in Al-Ahram Group?

Investing in Al-Ahram Group is a strategic decision that aligns with both current market trends and long-term growth potential. Here are compelling reasons why Al-Ahram Group stands out as a worthy investment opportunity:

- Market Leadership

As a leading plastic manufacturing company in Egypt, Al-Ahram Group has a proven track record of success and a dominant market share, ensuring stability and reliability for investors.

- Financial Strength

Demonstrated robust financial growth with a consistent increase in revenues, reflecting the company’s strong financial health and potential for continued profitability.

- Innovation and Adaptability

Commitment to innovation and the use of cutting-edge technology positions Al-Ahram Group at the forefront of the industry, ready to adapt to changing market demands.

- Sustainable Practices

Pioneering in eco-friendly product lines, including biodegradable and recyclable materials, aligns with global sustainability trends, offering a competitive edge in markets with increasing environmental awareness.

- Diverse Product Portfolio

A broad range of products serves multiple industries, reducing dependency on any single market and providing a buffer against sector-specific downturns.

- Strategic Expansion

Targeted expansion into European markets with sustainable products demonstrates the company’s ambition and strategic planning to capture new growth opportunities.

- Export Capabilities

With a significant presence in the MENA region and plans to expand further, Al-Ahram Group’s growing export capabilities present a clear path to international market penetration.

- Corporate Social Responsibility (CSR)

Strong CSR initiatives enhance the company’s brand reputation and foster goodwill among consumers, which is increasingly important for modern businesses.

- Experienced Leadership

A seasoned management team with a clear vision for the future ensures that the company remains focused on long-term goals and strategic initiatives.

- Alignment with Global Trends

The shift towards sustainable materials and practices places Al-Ahram Group in an advantageous position to meet the demands of environmentally conscious consumers and regulations.

Investing in Al-Ahram Group means partnering with a company that not only demonstrates financial resilience but is also strategically poised for sustained success in the evolving plastic manufacturing industry. Our commitment to innovation, sustainability, and global market expansion presents a compelling case for investors seeking alignment with a future-focused industry leader.

Shareholder Information

Al-Ahram Plastic Manufacturing is anchored by the strength and vision of our founding family shareholders. Their commitment has been the driving force behind our company’s legacy and continues to guide our journey towards excellence in the plastic manufacturing industry.

Ownership Structure

Founding Family Shareholders

The entirety of our company is owned by the founding family, whose members have been instrumental in establishing and growing the business from its early days in Shubra AlKheima to its current prominence. Their deep-rooted understanding of the industry and unwavering dedication to the company’s values and mission have been pivotal in achieving our market position and driving our strategic initiatives.

The company’s ownership structure is as follows

- Majed Halim

Ownership Percentage: 33.33%

- Hany Halim

Ownership Percentage: 33.33%

- Amjad Halim

Ownership Percentage: 33.33%

The Halim family collectively holds 100% ownership of Al-Ahram Group, with each of the three co-founders contributing equally to the company’s success. Their combined vision and leadership have steered the company through decades of growth and innovation, establishing Al-Ahram Group as a prominent player in the market.

Future Employee Shareholders

In line with our core belief in the value and loyalty of our employees, we are exploring the possibility of introducing an employee shareholder program. This initiative is designed to reward our employees’ dedication and hard work by offering them a stake in the company’s future. We believe that by aligning our employees’ interests with the success of the business, we can foster a culture of shared success and further strengthen our commitment to excellence.

Shareholder Engagement

Our approach to shareholder engagement is rooted in transparency and open communication. We ensure that our founding family shareholders are closely involved in key decision-making processes and are well-informed about the company’s performance and strategic direction. As we consider the introduction of an employee shareholder program, we will extend this philosophy to include our valued employees, ensuring they too are engaged and informed participants in the company’s growth.

Future Outlook

With the solid backing of our founding family shareholders and the potential to involve our dedicated employees as future stakeholders, Al-Ahram Plastic Manufacturing is poised for continued success. We are committed to leveraging our strong foundation to seize new opportunities, innovate within our industry, and uphold our reputation for quality and sustainability.

Investment Opportunities

- Badr City Project

Al-Ahram is embarking on an ambitious expansion with the Badr City project, aiming to increase the installed production capacity from 34,094 tons per annum to 86,000 tons by 2028. This significant growth is facilitated by the addition of new machinery and improved sourcing of raw materials. The project is seeking a total financing of $80 million, which includes $50 million for the capacity expansion and $30 million for additional working capital requirements. Investors have the opportunity to contribute to a project that is set to double production capacity, improve return on equity from 18% in 2022 to 32% in 2026, and expand Al-Ahram’s reach in both local and foreign markets. The strategic location in Badr City, near Cairo, offers logistical advantages and access to key markets, making it an attractive proposition for investors looking for growth and profitability in the manufacturing sector.

- Plastic Recycle Project

Al-Ahram is strengthening its sustainability efforts by enhancing recycling processes and exploring innovative technologies to increase the use of recycled content in production. The company’s initiative to recycle hazardous print waste, specifically solvent recovery, is a testament to its commitment to responsible waste management. By recycling and repurposing hazardous vapors as solvents, Al-Ahram is minimizing emissions and reducing environmental impact. This project not only aligns with global sustainability trends but also offers investors the chance to be part of a leading-edge solution in the plastic manufacturing industry that prioritizes environmental responsibility.

- Agriwaste Plastic Products

The Agriwaste project represents Al-Ahram’s pioneering venture into the circular economy, with a complete system that sources agricultural waste from its own 2800-acre organic farm in Aswan. This venture ensures a reliable supply of agri waste for plastic manufacturing, while also allowing for close monitoring and management of the supply chain. The company adheres to the highest environmental and social standards, ensuring sustainable practices and ethical sourcing. As Al-Ahram looks to expand its agri waste sourcing, investors have the unique opportunity to support the first complete circular economy project in the industry. This initiative not only promises environmental and social benefits but also positions the company as a leader in sustainable manufacturing practices.

Investors in these projects will be part of Al-Ahram’s journey towards a more sustainable future, with a focus on innovation, responsible sourcing, and ethical practices. The company’s commitment to sustainability and circular economy principles presents a compelling case for investment, promising both financial returns and positive environmental and social impacts.

Frequently asked Questions (FAQs)

Al-Ahram specializes in the production and distribution of high-quality plastic products, including a range of sustainable and recyclable materials. Our portfolio includes bio-plastics, foam products, and agricultural waste recycled products, serving various industries such as packaging, agriculture, and consumer goods.

We are committed to environmental responsibility and have integrated sustainability into our business model. This includes investing in eco-friendly technologies, pursuing zero-waste production processes, and developing products that are biodegradable and recyclable. Our sustainability efforts align with global environmental standards and practices.

Al-Ahram has demonstrated consistent growth with a strong financial trajectory. Our latest financial reports indicate an increase in production capacity, profitability ratios, and a strategic plan for expansion. Detailed financial information can be found in our annual reports and financial statements available on our website.

Our strategic growth plan includes expanding our production capacity to 86,000 tons per annum by 2028, diversifying into 15 new product lines, and increasing our export share. We are also focused on expanding our market presence both regionally and globally, particularly in the European markets.

Risk management is integral to our business strategy. We conduct thorough market research, engage in prudent financial planning, and maintain a diversified product portfolio to mitigate risks. Our experienced management team continuously monitors the market to adapt our strategies accordingly.

Investors have the opportunity to be part of a forward-thinking company that is poised for continued growth in the evolving plastic manufacturing industry. Our commitment to innovation, sustainability, and global expansion presents a compelling case for investment.

Interested investors can contact our Investor Relations team for detailed information on investment opportunities, including share purchasing options and investment procedures.

Yes, Al-Ahram has a dividend policy that reflects our commitment to delivering value to our shareholders. The policy is based on our financial performance and future investment needs. Dividend declarations are made annually and are subject to approval by the Board of Directors.

We maintain open and transparent communication with our investors through regular updates, annual reports, press releases, and investor meetings. Our Investor Relations team is also available to address any inquiries and provide assistance as needed.

The latest news, press releases, and updates about Al-Ahram can be found in the News and Media section of our website. Investors and stakeholders are encouraged to subscribe to our newsletter for regular updates.

For more information, please contact:

Mina Gamal

Investor Relations Manager